How To Add A Class Account To A Check Register In Quickbooks

If you desire to be sure that QuickBooks is keeping track of all of your transactions accurately, you should enter your banking company accounts into the programme, even if y'all don't use online cyberbanking. That said, yous should also record every dime that goes in or out of your bank accounts.

In this commodity, we are going to focus on managing your banking company accounts using QuickBooks. Please note this commodity assumes you lot have already gear up your depository financial institution accounts when yous fix QuickBooks.

Depositing Money That'south Non from Customers

In that location will be times you will receive money from sources who aren't customers. That means in that location will not be an invoice or a sales receipt. This kind of money could be in the form of a rebate check, a refund from a vendor, capital from an owner or partner, or a loan.

Inbound these types of deposits is piece of cake to do. You are simply going to apply the register from the appropriate bank account.

Go to Banking>Use Register, then select the banking company business relationship.

The business relationship annals window and so opens, and a transaction line will exist highlighted for you to enter the transaction. In this case, the transaction is a deposit.

At present, let's enter the deposit.

- Offset, change the appointment of the transaction, if necessary, to reflect the actual date of deposit.

- Press tab and get to the Number field.

- If a check number appears, delete it. Y'all can too just look until you lot enter an amount in the Eolith cavalcade, because, at that betoken, QuickBooks will delete the bank check number for you lot.

- Next, press tab to move over the next three columns, until y'all go to the Deposit cavalcade. Enter the corporeality of the deposit.

- Now, become to the Account field and assign the deposit to an account.

- Information technology is a good idea to put an explanation of the deposit in the Memo field.

When yous are finished, click the Record button.

Assign an Account to a Noncustomer Deposit

If yous are depositing your ain money, or money from owners/partners, into the business, then that money should exist posted from a capital account – or an equity account. Yet, if you are depositing money from a loan, y'all should mail it from a liability business relationship from the loan. If information technology is a refund from a vendor, you tin post it from the expense account that was used to pay the vendor. Employ mutual sense when choosing what account to assign a deposit. You tin can e'er ask an auditor for help, as well.

Depositing Coin From Customers

If y'all have invoices out to customers and receive payments for them, documenting those deposits in your QuickBooks checkbook tin can be a little more detailed than the process we used before in this article. That doesn't mean it is difficult, still, because we are going to walk you through step by step.

Naturally, you will start off by recording the client's payment. You do that by going to Customers>Receive Payments or Customers>Enter Sales Receipt. When you do that, (or if you take already done it), QuickBooks volition make a note that you lot take undeposited funds. At present, allow'due south larn how to deposit them.

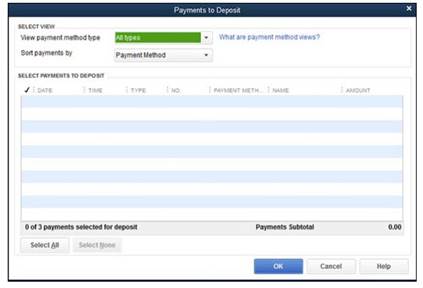

Go to Banking>Make Deposits. A dialog box will appear that tells you lot that you have undeposited funds. It will list the checks you lot have received, but haven't still deposited. Put a bank check mark beside the ones you want to eolith. Click OK.

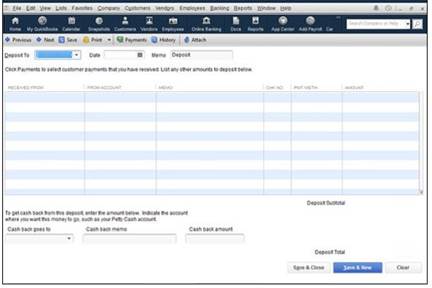

Next, pick the checking account you want to employ to record deposits. Go to the Eolith To field to do this.

Go to the Engagement text box and enter the engagement that you volition deposit this money into your bank business relationship.

In addition:

- Get ahead and add any other deposits you want to add to this bank account that don't come from customers.

- If you lot want to add a memo most this deposit, you lot tin do that, as well.

- If you desire cash back from the deposit, go to the Cash Back Goes To field, select the business relationship, create a memo, and so enter how much you lot want to go back.

Click Save and Shut when you are finished, to close out the window. If you have more than deposits, click Save & New.

Transferring Funds From 1 Business relationship to Another

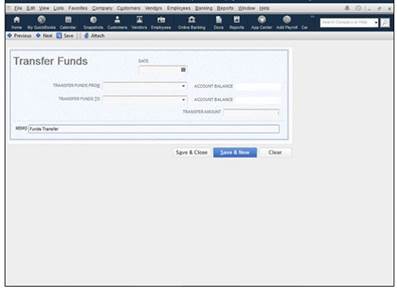

There volition be times when you want to transfer funds from one bank account to another. It is very common to do. Y'all utilise the Transfer Funds Between Accounts window in QuickBooks to do this.

Go to Banking>Transfer Funds.

Now, fill out the fields. Y'all volition exist asked for the date, the bank account you want to transfer funds from, and the residual of that account. So, you will be asked for the bank business relationship yous want to transfer funds to and the residuum of that account. Finally, you will be asked for the transfer amount.

Click Save & Close when you are finished. If you want to do another transfer, click Salvage & New.

NSF Checks

NSF Checks. We don't want it to happen. We'd rather it didn't happen. Just sooner or later, information technology is going to happen. You lot are going to get a bank check from a client returned by your depository financial institution, and it is going to be marked NSF, or not-sufficient funds. You probably know past now that this means your customer didn't take the money in the depository financial institution to encompass your bank check.

In earlier versions of QuickBooks, you would have had to chase your tail all over the programme to brand changes related to the bad check. You would have had to go into your banking company register, create credit memos, and the list goes on. Notwithstanding, the Bounced Checks feature in QuickBooks makes information technology easier to accept care of a bounced check.

Here's how to do it:

Go to the Receive Payments screen and find the client'due south payment.

To do this, go to the Customer Middle. Select the customer, then look on the correct side for the transaction that relates to the bounced check. Double-click the transaction. The payment screen appears.

Click the Record Bounced Check button under the Main tab.

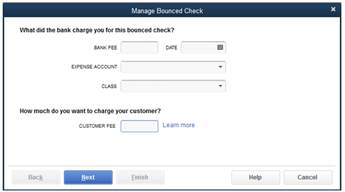

You volition and so see the Manage Bounced Check Window, as shown beneath.

Enter the fee your bank charged y'all for the bad check, equally well of the date of the accuse. And then, assign an expense account to that accuse. You lot can as well add a class if you want.

Next, specify how much you lot will charge your customer as a "bad check fee."

Click Next.

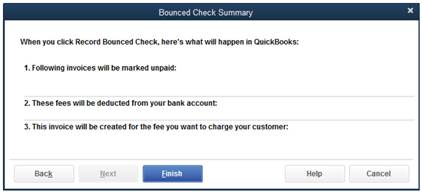

When you click Next, you will see the Bounced Check Summary that will prove you all the work QuickBooks has done for you lot. If you accept used previous versions of QuickBooks, you might remember that you had to practise all this yourself. QuickBooks does it for y'all.

Every bit y'all can encounter in the snapshot above, QuickBooks will go dorsum and marker the invoice unpaid. It volition likewise deduct the corporeality of the bounced check and the NSF fees from your banking concern account, equally well equally create an invoice to cover the bad check fee to the customer.

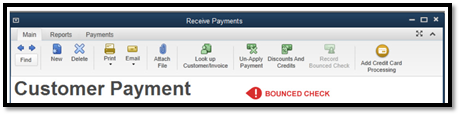

A bounced check indicator will then appear on your customer'south payment to let you know you used the bounced bank check characteristic.

Petty Greenbacks

Virtually businesses keep petty greenbacks on manus to comprehend things like lunch for employees, or concluding-minute office supplies. Yous will want to set up a lilliputian greenbacks business relationship in your chart of accounts, if ane is not already there.

Here's how to create 1:

- When you lot create a petty cash business relationship in your Chart of Accounts, the account type should be Bank.

- If you number your accounts, you should use a number for your picayune cash account that places it near your other banking company accounts.

- The opening rest of a petty greenbacks business relationship should be left at aught when you set it upward. You can tape the balance when you make the first eolith.

Put Money Into Petty Greenbacks

When you put money into little cash, nearly of the fourth dimension, you will transfer the money from your depository financial institution account (or write a check). Here'southward how yous practice it.

Make certain you take created the name Petty Cash in your Other Names list. You can open this by going to Lists in the menu bar.

Now, write a check from a bank account to Fiddling Cash, then postal service it to the little greenbacks account.

Recording Petty Cash Expenses

To record expenses paid for by petty cash, open the Write Checks window. Select the petty cash account every bit the account. It is easier to employ the Write Checks window to do this, equally opposed to the petty greenbacks register, because you can tie the expense to a customer or class, if y'all need to.

Setting up a Second Banking company Business relationship

You have already fix up one account in QuickBooks, but allow's say you lot desire to fix another bank account, after you have gone through the interview procedure.

To do this, go to Lists>Chart of Accounts. Click on the Depository financial institution push button, then select Continue.

Y'all will so run into the Add together New Account dialog box. Now you can fill in the name of the account, a clarification, and the Every bit Of information (or the date you opened the business relationship). M ake the opening balance zero for new accounts, so that you can enter your commencement deposit.

Printing checks is non like printing documents or spreadsheets. You accept to make sure that your printer is set to print them earlier you begin. In other words, it takes a little training. In addition, y'all need to tell QuickBooks what to put on your checks, from your company name, to the logo, etc.

Permit'due south outset by setting up the printer.

Become to File> Printer Setup. The dialog box below volition appear on your screen.

The Settings tab should be showing. If non, click on it.

-

Select Check/PayCheck from the dropdown list next to Form Proper noun.

-

Find your printer in the Printer Name dropdown list.

-

You will also have to select the printer type from the Printer Type option.

-

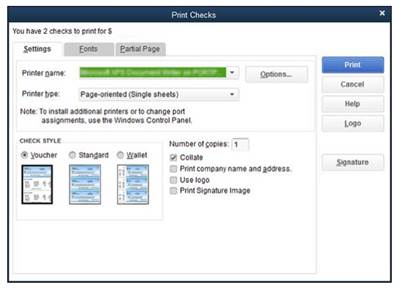

At present, select your check style. Let's cover those together. Voucher checks are just as wide as regular checks, just they are longer. This is because QuickBooks will also impress information on the checking account you are using, besides as the items and expense data from the bottom of the Write Checks window. Standard checks fit in legal envelopes. Wallet checks are checks that will fit into a wallet.

-

If you need to, click the Options push button and adjust your printer options. This is for specifying the number of copies, the quality of the print, etc.

Now click on the Fonts tab. This is next to the Settings tab. Choose the font, font style, and size that you want to use on the cheque.

Click OK when yous are finished with the fonts.

Adjacent, click the Partial Page tab. Select a Partial Page Printing style. This allows you to print fractional pages to save paper (for the environmentally friendly).

If you desire, you can click on the Logo button. A dialog box will appear. Click File, then find the graphic you desire to utilise. Click OK. Graphics must exist in BMP format -- or bitmap.

If you desire to add together a signature, click the Signature button, click File, and upload a signature file. Again, this must be a BMP file.

When yous are finished, click OK.

Printing a Check

If y'all have filled out a check and you want to print just that bank check, there'southward an easy way to do it.

In the Write Checks window, click the Print button.

QuickBooks volition and then show you lot a dialog box that shows you the cheque number to be printed. Make sure it is the right number. If not, alter it.

Click OK.

The Impress Check dialog box will at present appear.

These are the settings y'all only entered when you set up your printer. You can change them if you want to impress this bank check, simply these original settings are now your default settings. The next fourth dimension you print a check, the information in this box will revert to the information yous originally entered.

Click Impress.

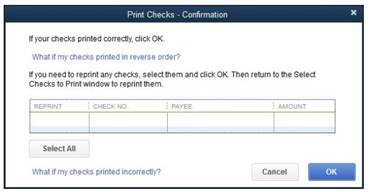

QuickBooks will enquire you if your checks printed correctly.

If your cheque printed correctly, click OK.

Printing Several Checks at Once

If y'all want to impress several checks at one time, we are going to tell yous how to do it.

Let's say you have but created a bunch of checks and want to print them.

On the last bank check that you create, click Save, then click the arrow that's below the Print icon nether the Main tab at the top of the window.

Select Batch.

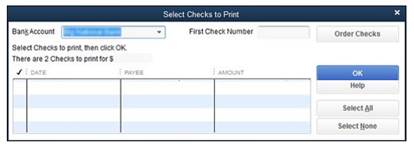

The Select Checks to Impress dialog box then opens. All unprinted checks will be selected. You can deselect any checks you lot don't want to print.

Click OK. The Impress Checks window then opens.

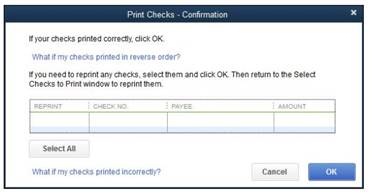

QuickBooks will ask you if the checks printed correctly later on they've finished printing. If they printed okay, click OK.

Now you can sign the printed checks.

Reprinting Checks

If a check doesn't print properly, you will accept to reprint it. If this happens, select the checks that need to exist reprinted in the Impress Checks-Confirmation window (shown above).

Select whatever checks that didn't impress correctly.

Click OK, and so go to File>Impress Forms>Checks to reprint them.

Press the Check Register

You tin can also print the bank check register. To practice so, start past going to Banking>Use Register, and so click the Impress icon. You may accept to choose the proper banking concern account from a dropdown list if you take more than one account. Click Ok.

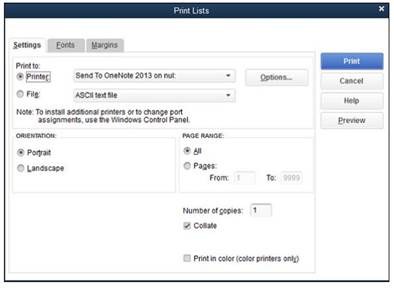

Become to File>Print Annals. You tin also click the print button at the top of the register. You will see the dialog box displayed below.

Enter the dates y'all want to print in the Date Range boxes.

If you desire the register to brandish the Items and Expense tab data when printed, check Print Splits Details.

Click OK.

Now click the Impress push every bit pictured higher up.

How To Add A Class Account To A Check Register In Quickbooks,

Source: https://www.universalclass.com/articles/computers/managing-bank-accounts-in-quickbooks-2014.htm

Posted by: hoytbeforged.blogspot.com

0 Response to "How To Add A Class Account To A Check Register In Quickbooks"

Post a Comment