How To Set Up Cash Receipts Template From Restaurant Register In Quickbooks

Many minor businesses practice not tape every auction for each customer. They may not employ a point of sale system, instead they may employ a cash register, a specialized program (like for medical offices) or another method to tape sales. These businesses need to record a summary of sales in QuickBooks. They want to know 'How tin can I tape daily sales' in QuickBooks?

The types of businesses who would want to record a summary of sales in QuickBooks include these types of businesses:

- Restaurant, bakery, bar, cafeteria, etc.

- Gift shop

- Retail store

- eCommerce with website sales

- Md, dentist or other medical office

- Spa, hair salon

- Many other minor businesses

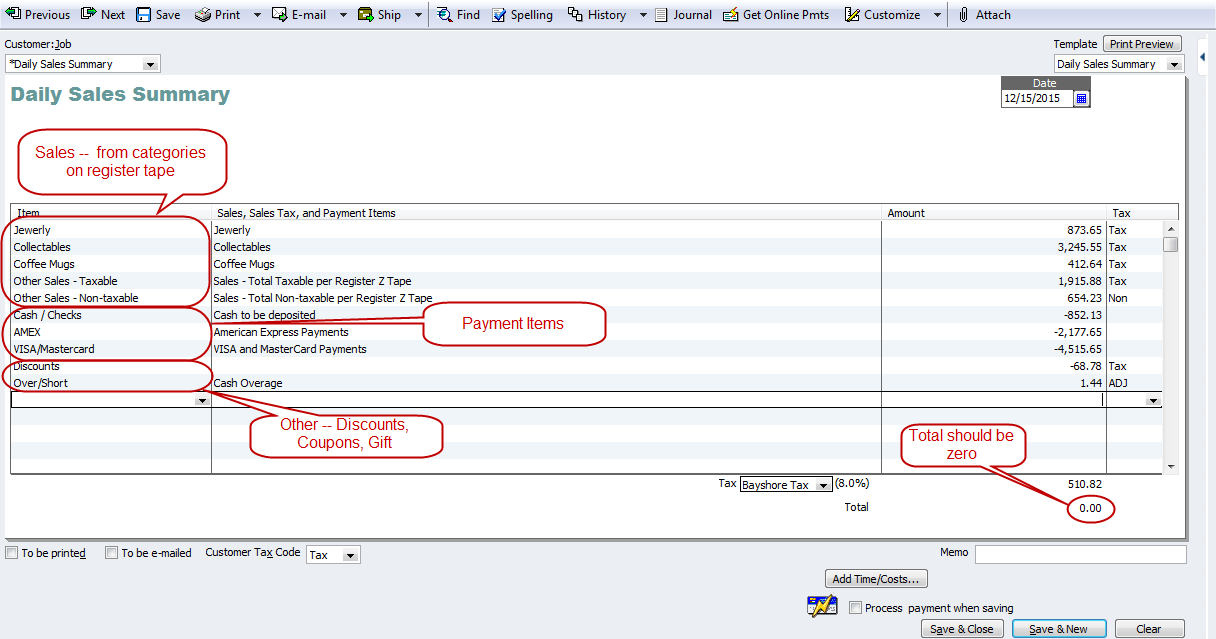

At that place are several names for recording a summary of sales in QuickBooks including a Daily Sales Summary, Zero Sum Sales Receipt, No Hassle Sales Receipt or other names.

Get-go, you need to set up upward items to record sales. Determine what level of item y'all want to track sales and the capacity of the register, etc. for tracking sales past category. For example you could set up items such every bit:

- Taxable and not-taxable sales

- Past Section — men, women, kids, accessories, etc.

- For restaurants — appetizers, entrees, desserts, bar, etc.

Consider the register tape or report and how you can summarize sales and ready up service items as needed. Then, set up payment items for the methods of payments accepted, such as:

- Cash/Check

- Visa/MasterCard

- American Express

- Discounts or coupons

- Gift cards redeemed

- Other

Using the register record (Z-tape) or report with the sales information, enter a Sales Receipt in QuickBooks which should internet to Zero as shown in this image (click the epitome to meet it larger).

You may want to customize the Sales Receipt Template to add custom fields to track additional data (similar customer counts, etc.). Memorize the Sales Receipt with zero amounts for each line. And so, yous tin but enter the actual amounts for each 24-hour interval. For more details, search QuickBooks Help for 'Enter Daily Sales'. For restaurants, there is a detailed blog post from The Sleeter Group hither.

Annotation: Runway Sales Taxes co-ordinate to the level of detail needed for the sales tax returns. For inventory, apply a periodic inventory method — record purchases straight to cost of goods sold. Periodically count and value the inventory on hand and accommodate to actual. Consult with your accountant or tax professional for assistance.

How To Set Up Cash Receipts Template From Restaurant Register In Quickbooks,

Source: https://longforsuccess.com/daily-sales-summary-for-retailers-restaurants-ecommerce-and-more/

Posted by: hoytbeforged.blogspot.com

0 Response to "How To Set Up Cash Receipts Template From Restaurant Register In Quickbooks"

Post a Comment